WASHINGTON D.C. - In a controversial move, President Joe Biden has launched another bid to cancel student loan debt, this time for up to 25 million borrowers, despite a previous attempt being struck down by the Supreme Court. The new plan, armed with a different legal basis, aims to avoid the pitfalls of the past—but not without raising sever

e concerns about its fairness and financial wisdom.

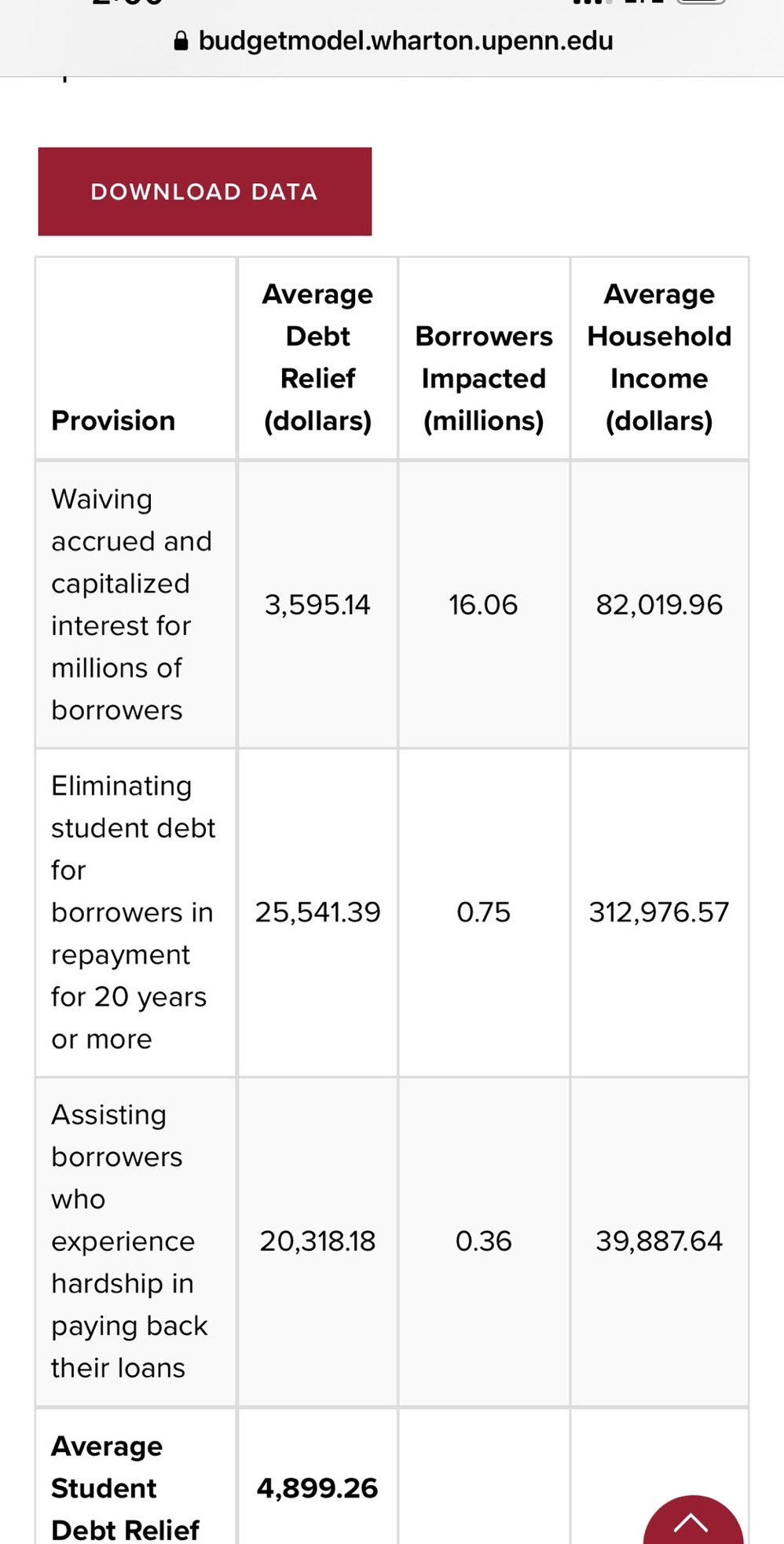

Could you take a look at the chart below? 750,000 people making avg of $312k/year getting the bulk of the $$ relief

The administration proposes to slash student loan balances by $5,000 to $20,000, with some borrowers seeing their debts erased entirely. While this might sound like a win for economic growth, as consumer spending could potentially increase, the reality is more complicated. The plan is expected to cost a staggering $559 billion in lost government revenue over the next decade, adding substantially to the national deficit without any strategy to recoup these losses.

Support my independent journalism. Become a subscriber for $5 a month, you can quit at anytime. If you are aleady a subscriber I thank you for supporting my mission.

Critics argue that the plan disproportionately benefits the well-off—predominantly those who pursued higher education and are thus more likely to land higher-paying jobs. In essence, a significant portion of this financial relief will go to individuals within the top 60% of income earners, not those at the lower end of the spectrum who arguably need it most.

This approach has sparked outrage among fiscal conservatives and even moderate Democrats, who see it as a misallocation of precious taxpayer dollars. They argue that the funds could be better spent on programs that directly assist vulnerable groups, such as low-income families, working parents, or older workers facing healthcare challenges. Instead, the Biden administration's plan seems to cater to a demographic that is less in need of financial aid, raising questions about the equity and sustainability of such sweeping debt forgiveness.

Make sure your friends see this. They may not know the truth.

Moreover, there needs to be an accompanying proposal to reform the sprawling student loan system, which means the cycle of borrowing and the ballooning national debt could continue unabated. This could set a precedent for future administrations to grant similar debt relief, turning higher education into an expensive entitlement funded by taxpayers.

As President Biden prepares for re-election, his push to wipe out student debt is seen by many as a politically motivated move to secure votes from college-educated Americans, rather than a genuine effort to reform education financing. The plan has been lambasted by opponents as "lawless" and an irresponsible gamble with the nation's fiscal future, favoring electoral gains over economic prudence. Critics warn that this sets a dangerous precedent, where fiscal responsibility is sidelined for populist policies that appeal to affluent voters.

Make sure all of your friends see this. Share this out everywhere.